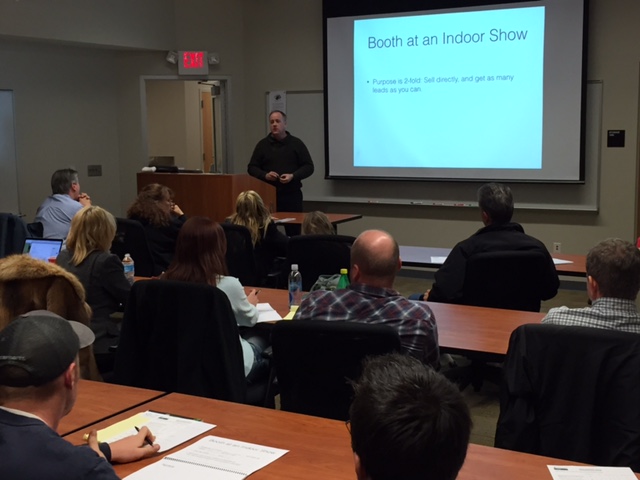

Seminars and Workshops

Starting a new business? Looking for new ways to expand? Want to add social media to your marketing? Try a Small Business Center seminar!

Seminars and Workshops

The CVCC Small Business Center offers FREE seminars and workshops to the public. Most are online for your convenience. After you register, you will be contacted by email with information and the seminar or workshop online link.

» CVCC Small Business Center - Training Events and Webinars

» NC Small Business Center Network - Training Events and Workshops sponsored by the State

If you have a disability that requires special accommodation, please contact the Small Business Center 72 hours prior to the event or contact the Counselor for Students with Disabilities, at accommendations@cvcc.edu.

Your own business, your own boss,

but...

where do you start?

Call the Small Business Center

at Catawba Valley Community College

(828) 327-7000, ext. 4117

|